Ira required minimum distribution worksheet

1 2020 based on the rules from the SECURE Act passed in late 2019. Get 247 customer support help when you place a homework help service order with us.

2

Required minimum distributions RMDs must commence by age 72 for those who were younger than age 705 prior to Jan.

. However recently enacted federal legislation increases the required beginning age for those born on or after July 1 1949 to age 72. At age 70½ you must start taking money out of your IRA and other tax-advantaged investment accounts such as 401ks according to IRS rules. Annuities held inside an IRA or 401k are subject to RMDs.

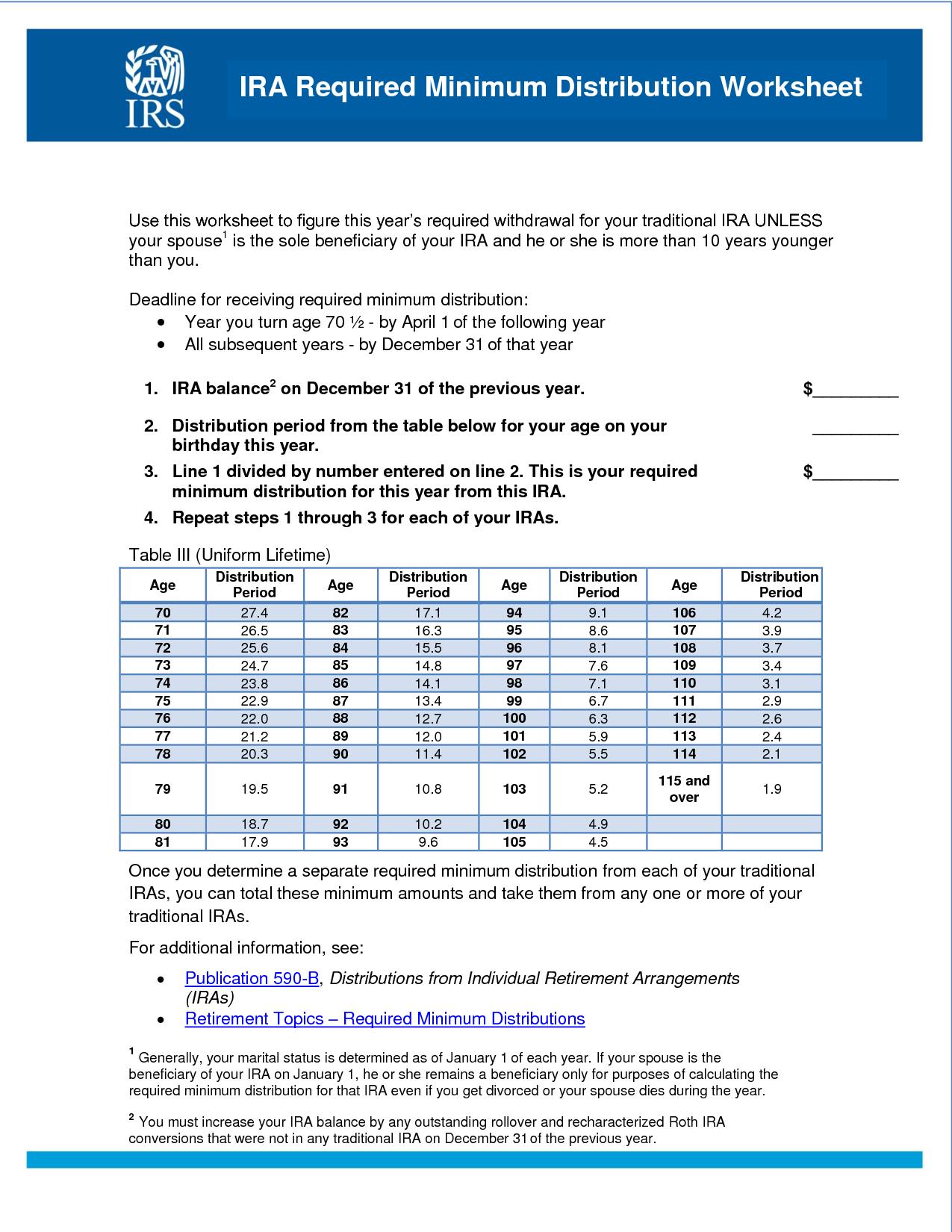

The new tables are not effective until 2022. If you used the IRA Deduction Worksheet in the Form 1040 instructions or as referred to in the Form 1040-NR instructions subtract line 12 of the worksheet or the amount you chose to deduct on Schedule 1 Form 1040 line 20 if less from the smaller of line 10 or. If your spouse 1 is the sole beneficiary of your IRA and theyre more than 10 years younger than you use this worksheet to calculate this years required withdrawal for your non-inherited traditional IRA.

Qualified HSA funding distribution. 31 2019 are required to continue their RMDs as required under the old rules. The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889 Health Savings Accounts HSAs.

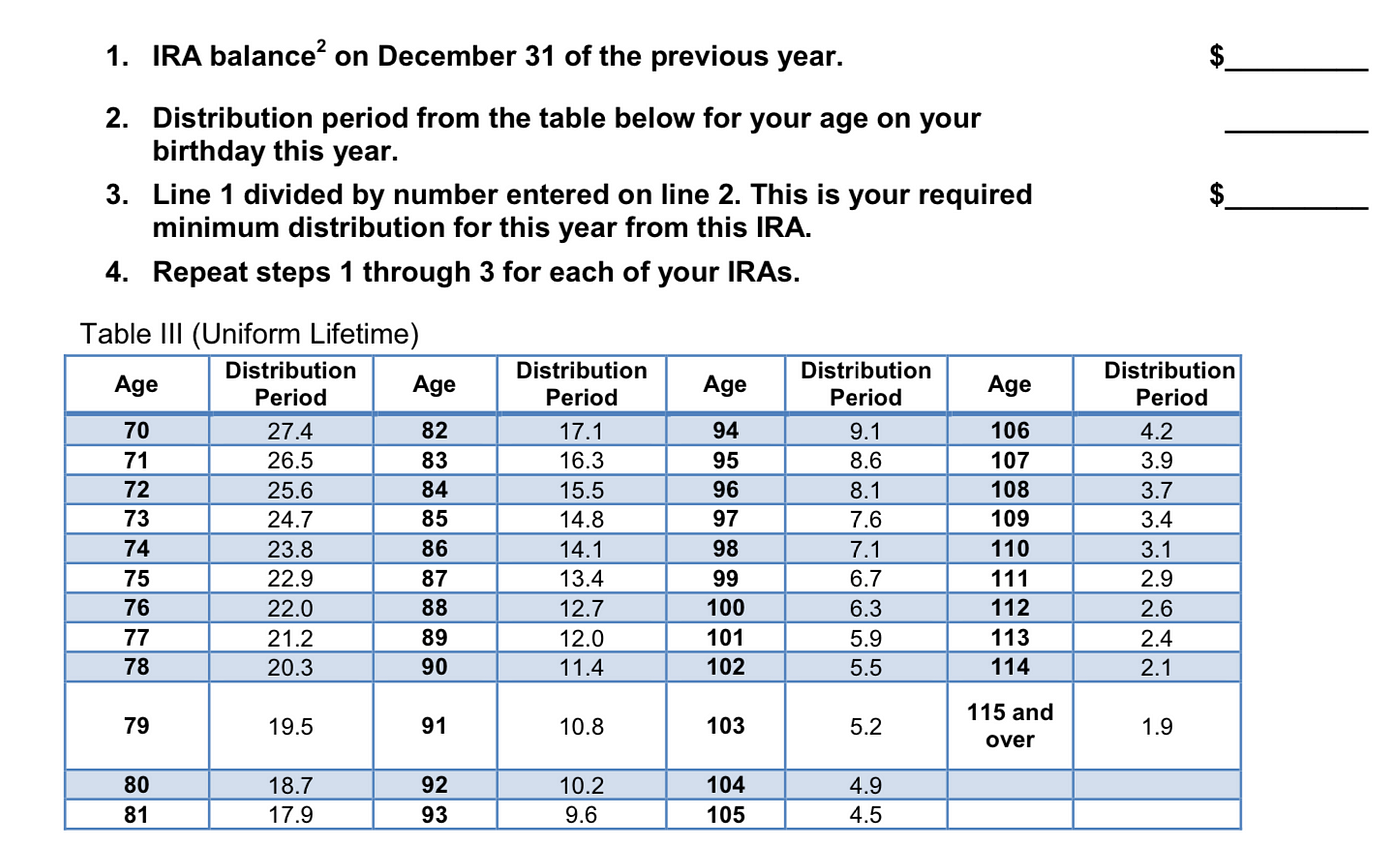

RMDs are calculated using the life expectancy tables issued by the IRS in Publication 590-B. If you paid back a required minimum distribution from an IRA last year you still have to report the payout on your 2020 tax return. RMDs are waived for 2020 and.

The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan qualified withdrawals from the Roth IRA plan. Use this form to request Putnam to calculate and distribute your required minimum distribution each year from your Traditional IRA IRA Rollover SEP SARSEP SIMPLE IRA Accounts 403b 401k Profit Sharing or. Or cashing out the account value.

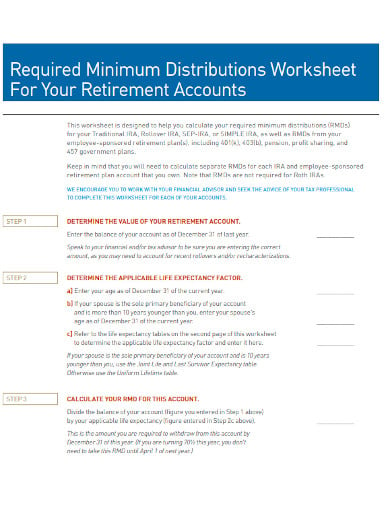

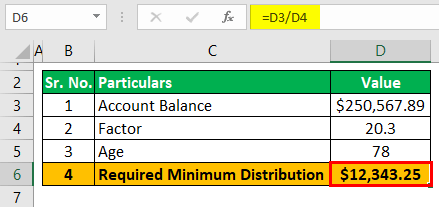

Thats because on November 6 the IRS released new life expectancy tables that are used to calculate RMDs. Make a one-time tax-reportable qualified charitable distribution QCD from an IRA. You will need to divide your IRA account balance by your life expectancy or distribution period to obtain your RMD.

First a little background on how RMDs work. That age is lowered to 70 12 if you reached it before January 1 2020. Use this worksheet for 2021.

A Retirees Guide to Key Dates in 2021. If you were born before July 1 1949 your required beginning age for taking RMDs remains age 70 ½. You dont have to worry about required minimum distributions if you have a Roth IRA unless you inherited it.

No minimum distributions are required during the Roth IRA owners lifetime. Retirement Account Required Minimum Distribution Request. You can find the distribution period using the IRSs Joint Life and Last Survivor Expectancy Worksheet if your spouse is the sole beneficiary and is more than 10 years younger than you or the Uniform Lifetime Worksheet for all other IRA owners.

Required Minimum Distribution - RMD. You can withdraw the money recharacterize the Roth IRA as a traditional IRA or apply your excess contribution to next years Roth. Year you turn age 72 70 ½ if you reached 70 ½ before January 1 2020 - by April 1 of the.

Historically federal tax law has set the required beginning age for RMDs at age 70 ½. You will face a 6 tax penalty every year until you remedy the. IRA Required Minimum Distribution Worksheet Use this worksheet to figure this years required withdrawal for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you.

The percentage gradually increases from roughly 36 at age 70 to more than 50 at age 115 for traditional IRAs. This lets us find the most appropriate writer for any type of assignment. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Download PDF 403b Plans. Required minimum distribution RMD is the IRS-mandated minimum annual withdrawal amount from tax-deferred retirement accounts for participants aged 70 ½ or 72 depending on the year they were born. The account balance youll use to figure this out should be what it was on December 31 of the prior.

You can look forward to somewhat smaller required minimum distributions RMDs from your IRA and company retirement savings plan beginning in 2022. When deciding between an employer-sponsored plan and an IRA there may be important differences to consider --such as range of investment options fees and expenses availability of services and. Required Minimum Distributions.

The general 401k plan gives employees an incentive to save for retirement by allowing them to designate funds as 401k. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401k account this year. A required minimum distribution RMD is the amount that traditional SEP or SIMPLE IRA owners and qualified plan participants must begin distributing from.

If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required minimum distribution. Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA and theyre more than 10 years younger than you. There is no required minimum distribution for a Roth IRA but for a traditional IRA you must start taking money out of the account by April 1 following the year you turn age 72 and by December 31 each year after that.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. A Roth IRA is an individual retirement account IRA under United States law that is generally not taxed upon distribution provided certain conditions are met. Required Minimum Distribution Worksheet - use this only if your spouse is the sole beneficiary of your IRA and is more than 10 years younger than you Required Minimum Distribution Worksheet - for everyone else use if the worksheet above does not apply.

But the timing of your distribution is important says Mark Copeland a founding partner at Signature Estate Investment Advisors in Irvine Calif. Use this worksheet for 2021. A qualified HSA funding distribution may be made from your traditional IRA or Roth IRA to your HSA.

Deadline for receiving required minimum distribution. Those who had reached age 705 on or before Dec. Then use Appendix A Worksheet for Determining Required Minimum Distributions to find out when you need to take your first RMD.

This distribution cant be made from an ongoing SEP IRA or SIMPLE. A Solo 401k also known as a Self Employed 401k or Individual 401k is a 401k qualified retirement plan for Americans that was designed specifically for employers with no full-time employees other than the business owners and their spouses.

2

2

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Ira Required Minimum Distribution Worksheet Pdf Download

Khabar Navigating Your Required Minimum Distribution

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Rmd Table Rules Requirements By Account Type

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Ira Required Minimum Distribution Worksheet Traditional Ira Pdf4pro

Required Minimum Distribution Calculator Estimate The Minimum Amount

Rmd Table Rules Requirements By Account Type

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Ira Required Minimum Distribution Worksheet Fill And Sign Printable Template Online Us Legal Forms

2

The Double Whammy Of Required Minimum Distribution In A Recession By Anthony Lawrence Pcunix Wrong Wrong Wrong Medium

2

Required Minimum Distribution Calculator Estimate The Minimum Amount